Think like a CFO: Four cash management strategies for startups during a crisis

Last week, we kicked off a new webinar series to help MATTER startups navigate the changing innovation landscape as a result of COVID-19. For one of the first conversations in this series, Lee Shapiro, managing partner at 7Wire Ventures and CFO of Livongo, shared encouragement and insights into how entrepreneurs can develop a quality survival plan hinged on strong cash management practices.

Having led organizations through the recessions of 2001 and 2008, Lee stressed that although startups and small business owners are facing an unprecedented economic situation and an uncertain future, there are important lessons we can learn from previous economic downturns.

“This crisis has put every one of our normal routines on hold,” Lee said, “but I hope what all of you don’t do is become paralyzed in the moment. Think about what the world is going to be like when we come out of this.”

Here are four questions Lee encouraged every entrepreneur to ask themselves. Responses have been edited slightly for length and clarity.

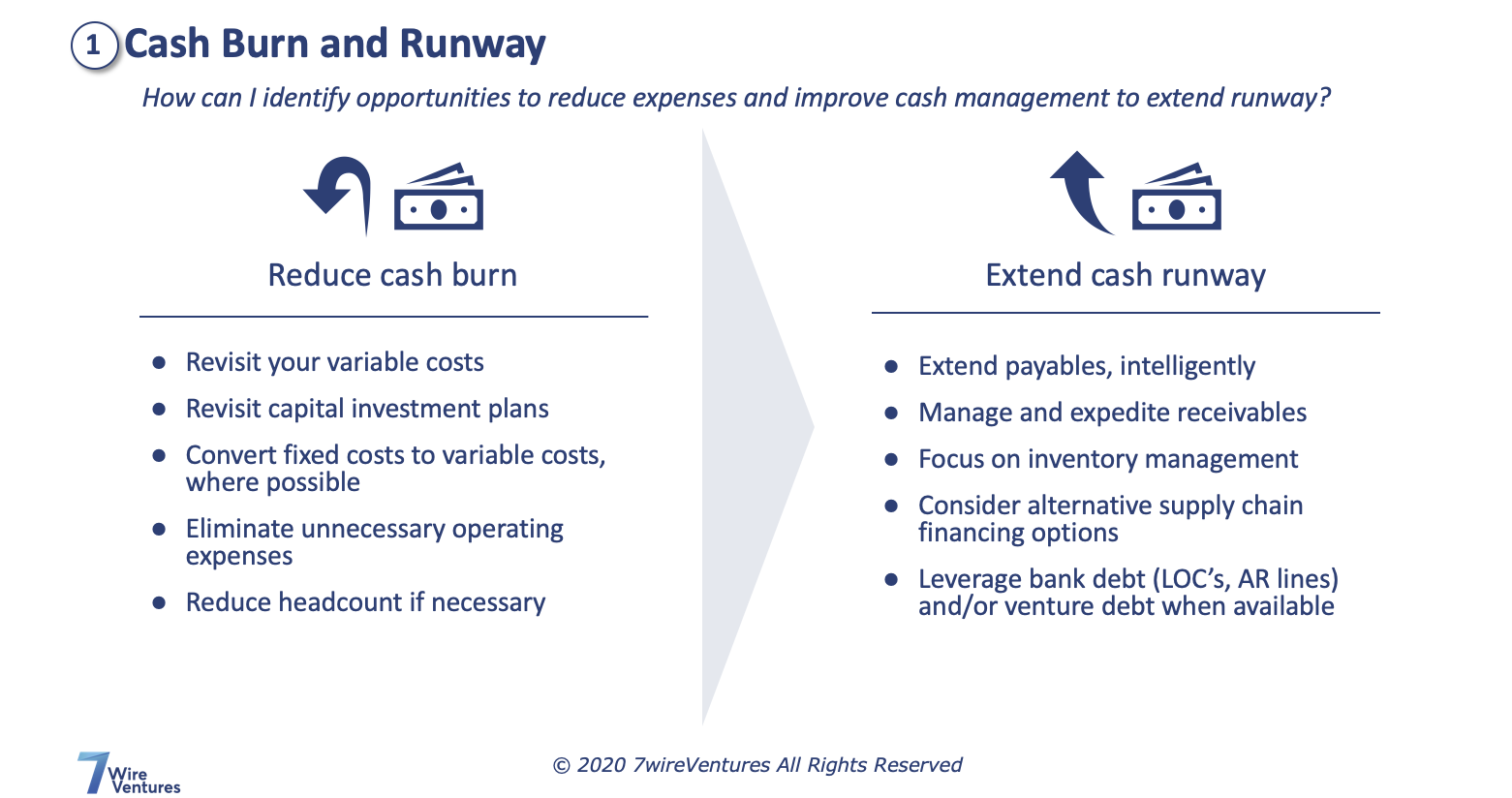

1. How can I reduce my cash burn and improve my runway?

Supporting your workforce

“By way of example, I was serving as an officer at Allscripts in 2000 when the dotcom crisis hit…Those were challenging times. The market was very, very tough for technology companies.

“What we did was look at areas where we could best manage our hiring plan. For those of you who had growth plans for this year, rather than telling your teams that you’re cutting back or there’s a hiring freeze, what you can certainly say is that you’re going to be much more circumspect with regard to new hires. And what you really want to do is preserve the jobs for those who are there now.”

Preserving sales

“From my perspective, the most important lifeblood of any organization is sales — that’s how you’ll find your way out of this. [Think about how] you can preserve some of your sales activities. That may mean delaying or extending delivery deadlines, but I think customers will be willing to work with you throughout this timeframe and maybe accept the fact that what you might promise in terms of delivery might take a little longer and slow down some development spend.”

Converting fixed costs to variable costs

“Wherever you can, try to make some of your fixed costs variable. Work with your suppliers — find ways to extend payments where appropriate. A lot of landlords, for example, are entertaining conversations with tenants about ways in which you might be able to delay payments. Think of some of your suppliers as a source of financing, because they want to keep you in business.”

2. What does my new business model look like?

Think creatively about your solutions

“This part of your cash management strategy might engage a different part of your brain in terms of thinking creatively, as opposed to just looking at the numbers in terms of where you sit. What else can you be doing with regard to your near term as well as longer-term business model to be able to adapt to some of these new environments?

“You might find, for example, that there’s benefit in being able to provide solutions that meet the needs of our broader community. That goodwill is something that’s really important.

“Also think about whether or not there are new opportunities for you — whether that’s working through government agencies, working through Red Cross resources, working through local healthcare organizations — to be distributing your solutions.

“One of our portfolio companies provides remote physical therapy. For quite some time, they were delivering that service through health plans who wanted to drive better outcomes, because in many cases, larger physical therapy facilities thought of that solution as being competitive with their onsite delivery of physical therapy. Now, frankly, there are unique challenges to giving people in-person physical therapy, and that’s affected health outcomes. This company has revised their go-to-market strategy and has created new partnering solutions that they’re working on with physical therapy facilities to extend their reach to provide new, white-labeled solutions and deliver new business into the market.”

Understand the changing needs of your customers

“If you are having regular dialogue with your clients, you’ll understand what some of their needs are. Another one of our portfolio companies is doing outreach into underserved communities. They’ve had COVID-19 resources that they’re providing to populations, principally in Medicaid, to allow those people to do some self-evaluation of what their needs are and to capture data and to share that with physician groups as well as with health plans. You can’t imagine how great it is for those individuals to be able to know that there’s someone reaching out to them to see how they’re feeling, as well as for plans and other sponsors to be able to get new forms of data to serve them.”

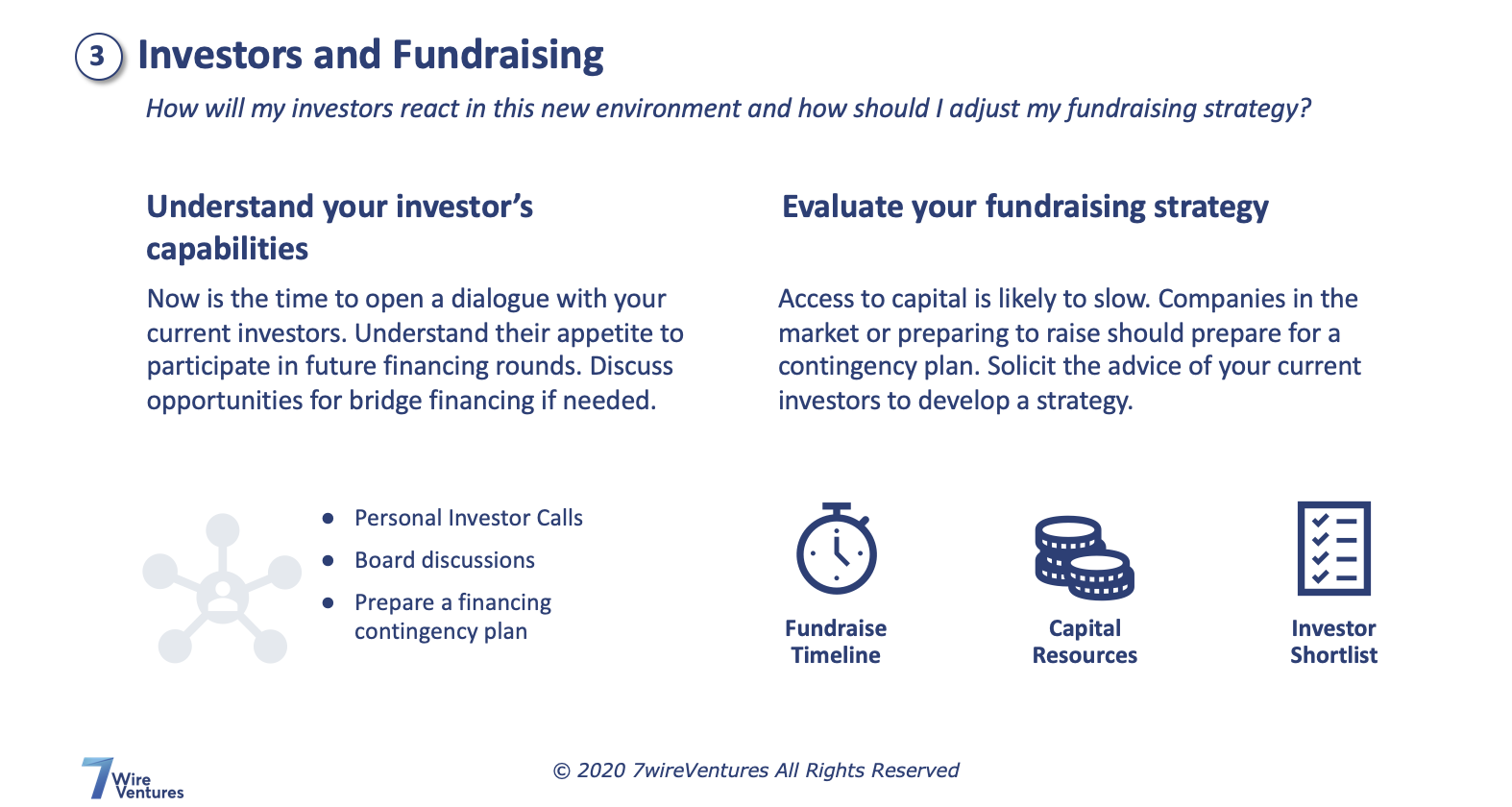

3. How will my current investors react, and what is my revised fundraising strategy?

Demonstrate value to your existing investors

“For many of you who have done financing, you should be asking questions of your investors now about their likelihood of being able to participate in future rounds. I think if there’s an opportunity to get bridge financing at this time, and to have dollars available to you to bridge the current gaps that you might have in your funding, that could be really important.

“Have a financing plan to share with them to show what it is you’re doing to better manage costs and better manage your payables to defer payments over time. Those are all things that you should be looking at and presenting with some scenario planning in terms of what this means — for your target market as well as your own company. What happens if unemployment goes to 10 percent, which is what we saw in the 2008/2009 financial crisis? The Fed this week said that in fact, under a worst-case scenario, unemployment could hit close to 30 percent. And if that’s the case, how does that impact your business?”

Build your network now

“Certainly what we’re going to find, if the last two slowdowns were any indication, is that funding will slow and there will be a shorter list of investors to go to. Doing outreach now to investors that you’ve spoken with previously, to let them know that you’re around, you’re still in business, that you want to stay in touch with them, is important. Even if you’re not looking for funds right now, reach out to get their perspective on how they see the market resolving and who they think might be playing in the market under these new circumstances. Building your network is a really important part of these readiness activities.”

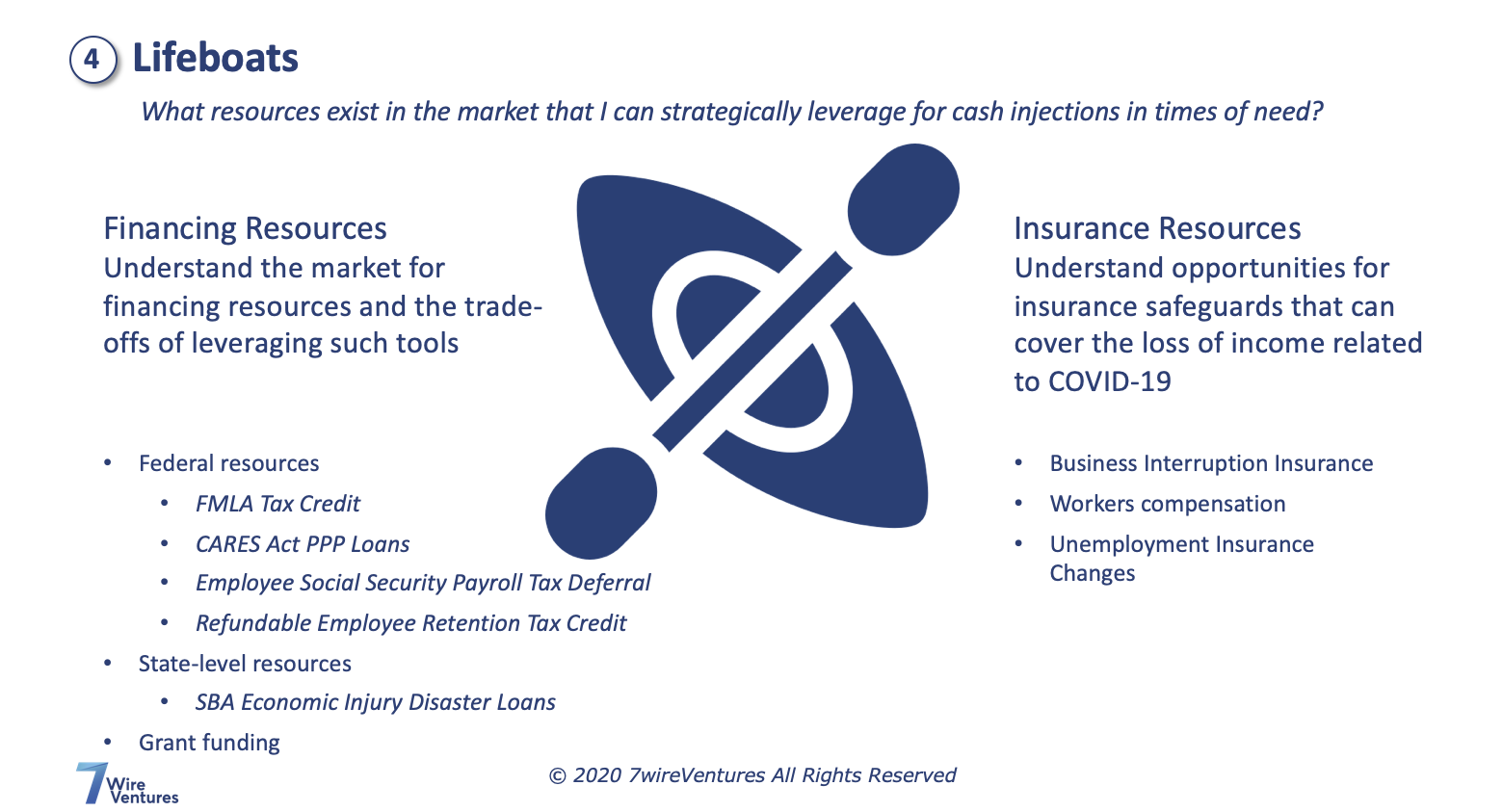

4. Are there lifeboats I can leverage for short term disruptions?

Financing resources

“There are a number of federal and state-level financing and grant resources available in the market that you should be able to take advantage of. SBA loans are clearly an important source — I can’t tell you enough. The banks are essentially being given this money with a mandate to put it out — so the sooner you can apply, the sooner you can go through the review process and begin to engage, because there will be a delay based on the number of small businesses that are coming forward looking for money at this time.”

Insurance resources

“In addition, some of you may have insurance that covers some of your needs. In looking at policies for business interruption insurance within our portfolio and seeing work from some of the large insurers, many of them have clauses that exclude events like this. Either way, it’s worth checking to see whether or not your policy provides some basis for support. Even if it doesn’t, reaching out to your insurance broker to find out what might be available to you is something that I strongly recommend you do, because there are insurers who are providing programs for their insured populations to help them through some of the challenges that they’re facing right now.”

For more information on the resources available to small businesses during this time, here’s a roundup of funding opportunities from our partners at mHUB.

If you’re a MATTER member interested in participating in more member-exclusive webinars like this one, contact info@matter.health.

If you’re not a MATTER member and are interested in learning more about offerings like this, contact daniel@matterhealth.