Is the Startup Funding Bubble Deflating? Not for Healthtech Innovators

TheWall Street Journalpublished an article recently that put a point on what many investors have been saying for some time: we are seeing a contraction in the amount of venture capital funding available to entrepreneurs. The article specifically noted that Q1 represented the largest quarterly decline in VC funding since the dot-com bust – a 25% fall in cash deployment across all venture markets from Q4 2015 to Q1 2016 and a four-year low in the number of transactions completed. One prominent VC, Bill Gurley, also recently posted on the dangers of the “unicorn financing market” and the potential challenges facing the industry due to inflated valuations of many high-flying startup companies.

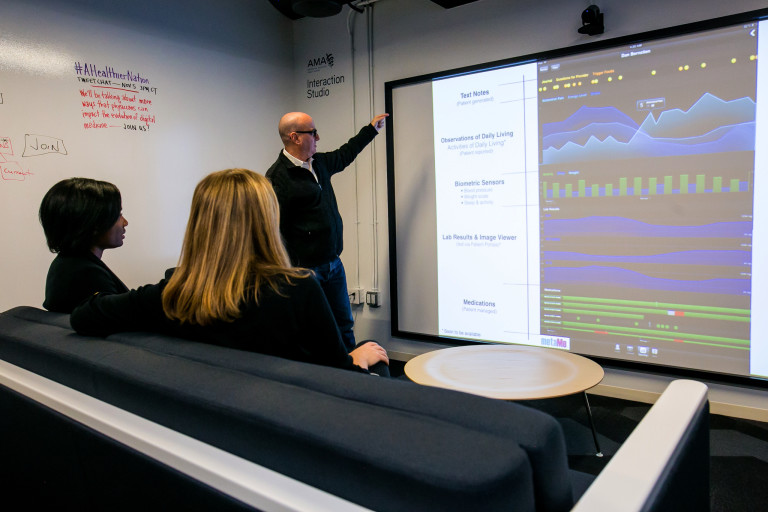

MATTER member Danny Bernstein of Metame, a platform for tracking and analyzing food consumption in patients with IBS, demos his product to investors at MATTER.

For the 125 startups at MATTER, many of whom are currently – or will be shortly – raising capital, this all could be very bad news … so we asked a few VCs who look at lots of healthtech deals for their perspective. “There’s no doubt we’re seeing some market-wide concerns, but it’s dangerous to read too much into one data point,” said Pritzker Group Venture Capital Partner Adam Koopersmith. “It’s not necessarily indicative of a massive swing of investment activity.” Indeed,Mattermark’s Q1 financing analysis concluded that the percentage changes in the number of deals and cash deployment from Q4 to Q1 were statistically insignificant. And Startup Health’s report on digital health investing found that Q1 was, in fact, the strongest funding quarter on record.

“The capital pull back is real, but no need to panic. Key is managing your cash burn to value creation milestones,” says Noah Lewis, managing director at GE Ventures. “Downturns are a routine part of any financial market’s fluctuations, venture capital included. We remain bullish on software- and tech-enabled services that enable healthcare stakeholders to transform their fee-for-service business models to value based care. This mega trend and related opportunities will continue unabated.”

“There is no doubt healthcare investing has some serious momentum that will only continue with the announcement of funds from strategics such as Illumina and OSF HealthCare,” says Koopersmith.

Indeed, at MATTER we see continued strong interest from investors in meeting new healthcare technology companies, and a continually expanding and vibrant community. With 125 healthcare startups and deep connections to Midwest universities, MATTER has become a magnet for investors looking for healthcare technology companies to invest in. “Because of the market shift from fee-for-service to value-based care, healthcare feels greater pressure than other industries to develop and adopt new innovations and technology solutions,” says MATTER CEO Steven Collens. “This level of demand should help cushion healthcare entrepreneurs against potential softening of the broader venture capital markets.”

Dan Watkins, co-founder of Mercury Fund, meets with healthtech entrepreneurs at MATTER’s 2016 Midwestern University Healthtech Showcase

“While it’s a good idea in markets like this to conserve cash and look to extend runway, the fundamentals behind the growth in healthcare startup activity point to continued strong demand for new technologies and services, and therefore to continued strong opportunities for investors,” added Collens.