Tales from the Trenches: David Jonas of PharMEDium

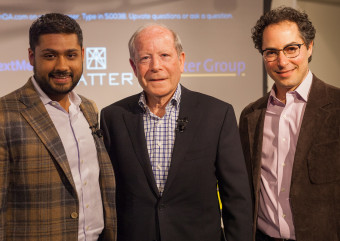

David Jonas, founder of PharMEDium Healthcare Corporation, sat down with ContextMedia CEO Rishi Shah at MATTER’s latest iteration in theTales from the Trenchesseries. The hour-long conversation revolved around Jonas’ 35+ years of healthcare industry experience including hiring practices, the importance of service as well as product, and the staggeringly high stakes in healthcare. Watch the interview highlights and read our summary below.

Born in Israel, Jonas spent more than two decades at Baxter International as the chief financial officer of renal therapy services when he saw an opportunity to strike out on his own. Baxter had long practiced compounding – mixing drugs for pain management, surgeries, and epidurals – but was planning to cut the business segment loose in 2003. Jonas seized the moment and left Baxter to start a new company mixing drugs for hospitals who outsource ready-to-use compounding products.

Jonas stressed identifying value proposition in the early stages of entrepreneurship. “You have to decide how different you are. You have to define what the customer wants and needs. Understand both the cost and the value,” said Jonas. In PharMEDium’s case, that value came from providing exceptional customer service. “In today’s environment, you can have a phenomenal product, but the service component will make or break your product,” said Jonas.

PharMEDium set out to provide a drug compounding service which included procurement, sterilization, mixing, packaging, and distribution. This meant building expensive facilities and infrastructures and hiring a core team. Jonas was deliberate in bringing in the right talent to augment the business, and bought 500 contracts from Baxter. “We needed people with an entrepreneurial spirit, who enjoy change, but also adhere to standard operating procedures. No cowboys,” he said.

Patient safety keeps Jonas awake at night, and loose cannons terrify him in the high-stakes drug compounding industry where any mistake could be deadly. Maintaining quality control and sterile procedures that comply with the U.S. Food and Drug Administration is fundamental to compounding, and PharMEDium excelled at it. Today, the company has about 70 percent of the market, according to Crain’s Business.

PharMEDium was able to become the market leader in sterile compounding by fostering a meticulous company culture. With success, however, comes accountability. Jonas recalled an incident involving a competitor whose contaminated batch of steroid injections caused meningitis and resulted in more than 60 deaths and about 750 injuries in 2012.

“This is unacceptable when a customer is trusting you,” said Jonas. “In 2003, The Drug Quality and Security Actpassed and clarified the regulatory environment that we were subject to. This brought in all the investors,” said Jonas. This investment buzz continued, and in Fall 2014, PharMEDium was preparing to file their initial public offering. At the 11th hour, Jonas “got an offer that was too attractive to pass up,” and AmerisourceBergen acquired PharMEDium for $2.5 billionin November of that year.

“In the last few years, I started spending time in private investment, VC, and in bringing my healthcare experience to the table,” said Jonas. He had founded JVC Investment Partners in 2000 and currently serves as its president. His son Jonathon Jonas, who is a partner of JVC, sat front and center in the auditorium to listen to his father.

Rishi asked which market is most ripe for disruption. Jonas said that the U.S. is, but that Israel is the best for biotech – in particular, cardiovascular tech and neural modulation. As a born and bred Israeli, Jonas will now look back to his home country to invest in the IT business. Watch the full interviewand join us for our next Tales from the Trencheson Thursday, June 23.