Money matters: Scenario planning and positioning your startup for funding during a crisis

The economic landscape is rapidly changing — so how can startups ensure that they are prepared for financial success in both the short term and the long term?

At the latest webinar in our member-exclusive Navigating COVID-19 series, Sue Mulligan, founder and CEO of Agile Advisors, joined us to share her insights into best practices for scenario planning and financial modeling and how startups should approach their relationships with venture capitalists (VCs) during and after the COVID-19 pandemic.

Here are those insights. Responses have been edited slightly for length and clarity.

Financial modeling fundamentals

Know your cash runway — and be honest and realistic

“Historically when I’ve talked to startups about projections, I’ve tried to drill into every single one of them that startups don’t fail because of a bad product; they fail because they run out of cash. You have to know what your cash runway is. This crisis has absolutely highlighted the importance of having cash, because that’s the only way we’re going to survive.

“Startups don’t fail because of a bad product; they fail because they run out of cash.”

“You should also be conservative. Best practice is to be honest and realistic — VCs don’t want to see shooting for the stars anymore. Everything has changed and you have to understand the impact of the shutdown on our economy as part of your projections.”

Bottom-up vs. Top-down financial modeling

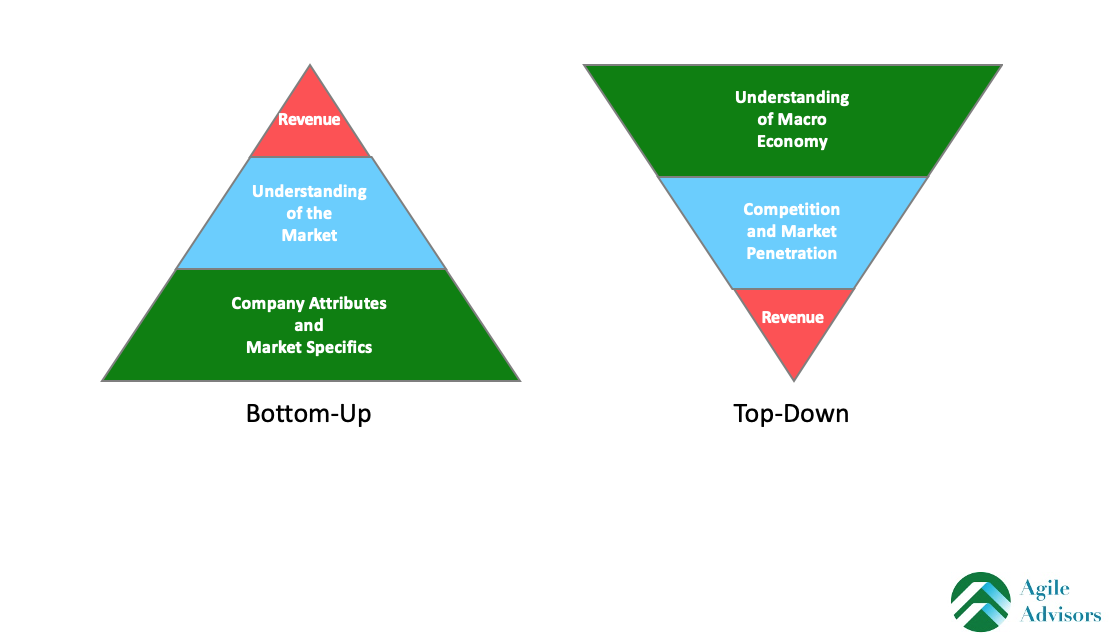

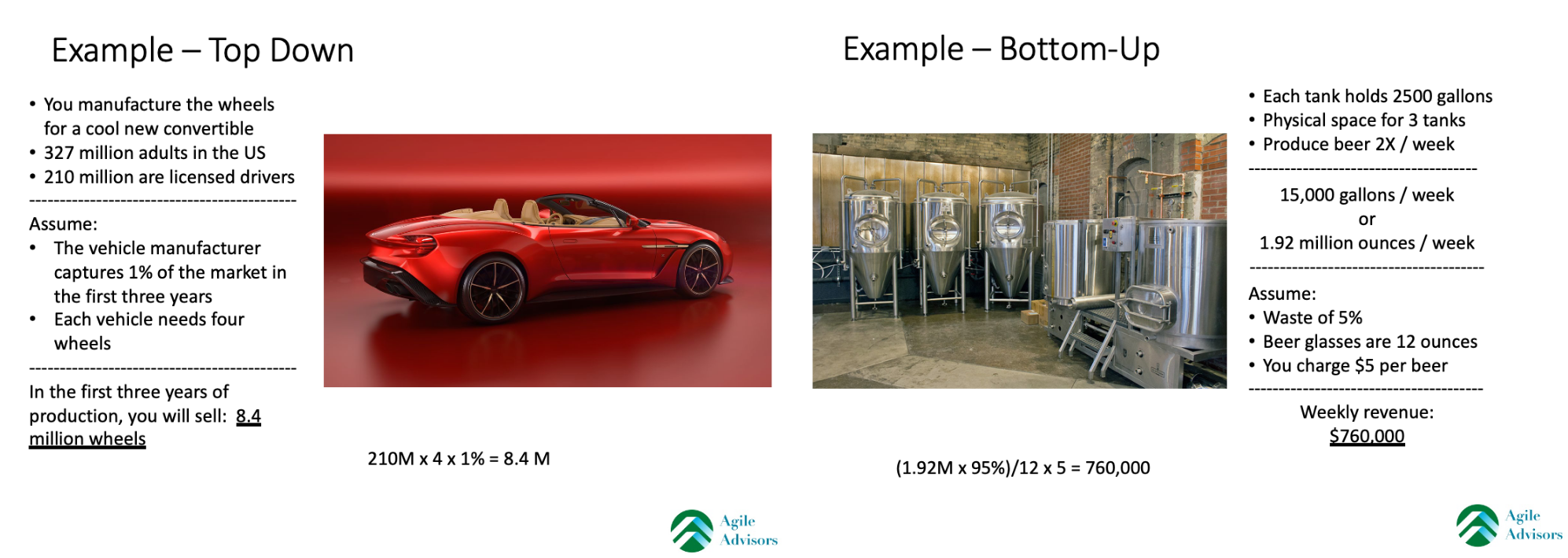

“There are two different methods of determining your revenue: the bottom-up approach and the top-down approach.”

“With the bottom-up approach, you start with your company attributes and market specifics. You layer onto that the understanding of the market and that’s how you generate your revenue. You’re using the constraints of your business, as opposed to the strengths of the economy, to come up with your revenue.

“With the bottom-up approach, you start with your company attributes and market specifics. You layer onto that the understanding of the market and that’s how you generate your revenue. You’re using the constraints of your business, as opposed to the strengths of the economy, to come up with your revenue.

“In a top-down approach, you’re starting with the understanding of the macroeconomy and narrowing it down based on your competition and market penetration. That’s where you’re getting to your revenue.”

“The more realistic approach is always going to be the bottom-up approach because you have to take the constraints of your business and understand that and how that affects the market, how you take the constraints and how it works within the market.”

“The more realistic approach is always going to be the bottom-up approach because you have to take the constraints of your business and understand that and how that affects the market, how you take the constraints and how it works within the market.”

Make your revenue modeling as robust and accurate as possible

“Understand what the important factors will be when we get out of this crisis. What percentage of your normal revenue will you realistically be able to achieve each month?

“For example, if this is a restaurant, how long is it going to take people to feel comfortable enough to go back to a restaurant, versus a hairdresser who, as soon as the gates open, will have people running in? You have to consider how your business falls into this economy, how the new remote landscape fits into your projections and when you think that you can be back to 100 percent capacity.

“You should have a ‘what if’ scenario of high, medium and low sales and be able to say what your plan is if you hit the high sales mark versus the low. It could be that it takes six months to ramp to where you were…Those are the kind of what if scenarios that are going to be critical and help you and others know where you’re at. You’re going to have to go back and monitor those scenarios periodically and adjust accordingly.”

Venture capital in a COVID-19 world

What VCs expect to see post-COVID-19

“When the dust settles, you are all probably going to go out and raise capital, and VCs are going to want to see solid, attainable projections. How much do VCs expect to see? Historically it had been that five years of projections were preferred, but three years were required. With every single one of their portfolio companies, what their projections showed or what they were projecting has all changed. What VCs are going to want to see now is the three years and how you have recovered from this and become a better and stronger company.

“They’re also going to assume an uptick — a slow down now, but a gradual uptick to overcome the lost business and the lost revenue. They’ll want to make sure that you understand the full impact of COVID-19 and what this crisis is doing to our economy. When you put together your pitch deck, your projections can be summarized annually, but you’re going to need to have a monthly backup on the side. In most cases, depending on the amount of capital being raised, VCs will ask for detailed projections behind it.”

Who are VCs investing in?

“First of all, VCs have had to spend the last couple of weeks righting their own ship and understanding how they can keep their staff on board and really trying to get their arms around the different programs that are out there to help their portfolio companies. Then they had to take a look at what capitalization looks like internally and how they can use their capital and funds to invest in their existing portfolio companies. They also had to look at their existing portfolio companies and know which ones are going to survive this and are worth continued investment and which ones are not.

“Right now, VCs are investing primarily in telehealth, remote learning and connectivity and fintech. They’re also investing in companies that are looking to survive in this new economy. They’re going to be looking for a clear path to profitability, so instead of focusing on expanding your company, the VCs are going to be looking at companies that have sales. So instead of trying to hire, hire, hire, focus on sales, sales, sales.

“They’re also going to want to see sustainable growth. If they’re looking at a toilet paper company right now, for example, everybody’s hoarding toilet paper. When things start to go back to normal, is the growth that toilet paper companies have seen in the last three months sustainable? No…VCs aren’t going to want to see companies that were just a blip in the radar during this lockdown — they’re going to want to see companies with sustainable growth.”

“VCs aren’t going to want to see companies that were just a blip in the radar during this lockdown — they’re going to want to see companies with sustainable growth.”

Obstacles to fundraising

“What we’re going to see over the next few months is that valuations have completely changed and it’s going to be increasingly hard to determine what your valuation is going to look like. With deals, we were getting to the point where there was a focus on company-friendly deals, but now it’s going to be heavily investor-friendly deals. That’s because investors are going to be more conservative and there are going to be a lot more companies looking for funds.

“One of the big obstacles that we’re seeing is that typically, VCs don’t invest in a company when they haven’t toured their operations and met their key leadership in person — and that’s not happening right now. Because of that, VCs aren’t lining things up for later in Q2 and Q3, and that can cause a slow down because the deals aren’t queued up yet.

“The other problem is that if you go right now and look to a VC and throw them your pitch deck, they’re going to question, first of all, whether or not you understand the impact of COVID-19, and second of all, are you desperate? Is that why you’re seeking capital? This is not to say that you can’t re-establish contact with a VC that you’ve been talking to and say, ‘Hey, look, here’s what we’re doing.’ But generally speaking, companies right now really need to sit tight because unfortunately, VCs are going to question why you are looking to fundraise now in such a negative economic situation.”

So, what should you do right now? Focus on what you can control.

Be first in line for financial assistance

“When the SBA and these major banks are finally launching their programs and we’re getting our funding, look at what you can control. Be first in line for those loan applications.”

Improve your product

“As companies, how do we spend this time during this economic shutdown as efficiently as possible? Number one is looking at your product and improving it as best as you can. Look at new use cases — it’s a great time to spitball different ideas and see what sticks. You didn’t have that time before…Use it to improve your product and see where else it can be used in this changing economy.

“Use this time to look at strategic partnership opportunities. If you’ve already got a VC that you’re working with, look to them and say, ‘Hey, here are our ideas about how we can stay afloat and stay in business’ and ask them for their perspective.”

Spend time reassuring your customers

“You can control the quality of customer service that you deliver right now. I guarantee you that every one of your customers is just as nervous as you are. Reach out to them and assure them that you’re here for them…and stay in contact. It doesn’t cost us anything to give better customer service. We all have time now and that’s going to pay off in the long run.

“When you can finally pitch to your clients, demonstrate operational prowess. Demonstrate to them that you were able to pivot, that you were able to look at new use cases for your product and that you were able to streamline your operation and weather this storm. Ensuring that you are capital efficient and will continue to be capital efficient is critical. You are the steward of their cash.”

“When you can finally pitch to your clients, demonstrate operational prowess.”

Be the leader your team needs

“Just as you are nervous and running your business, they’re nervous about whether or not they’re going to have a job. Use this time to build on the relationships with your employees and contractors. It’s also important to have mindshare within your team. They know your product in different ways. Get together with them and ask, ‘How can we improve our company right now? What do you think has been lacking?’

“Use the time to establish a relaunch strategy as a team. How are you going to blow your sales out of the water as soon as the economy opens up? That could involve that new product, a product you’re improving or the new use cases and come together with that relaunch involving your team. Nobody can come up with all of these ideas, and be as successful, alone.”

Learn from more experts like Sue at one of our MATTER workshops. See upcoming workshops here.

If you’re a MATTER member interested in participating in more member-exclusive webinars like this one, contact info@matter.health. If you’re not a MATTER member yet and are interested in learning more about offerings like this, contact Daniel Wexler, venture acceleration coordinator at daniel@matter.health.